- Banana Accounting - Double-entry Accounting | Banana Accounting

- Banana Accounting Review

- Banana Accounting Tutorial

Easily stay on top of your finance and

prepare a VAT Reporting for the United Arab Emirates

Quickly enter transactions

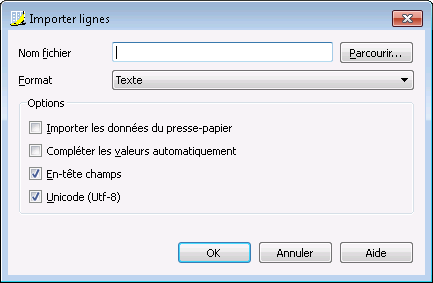

Enter, copy and paste or import e-statement. You can modify data at any time for perfect results.

Secure data entry

You get suggestions and all entered data is immediately checked and verified.

Instant results

Always up-to-date balances and accounting charts.

Multi currency accounting template

with VAT for enterprise

Double entry accounting for keeping track of the VAT transactions and printing a VAT Report for UAE.

A ready to use professional accounting template, only need a fast data entry and then you will get the professional results.

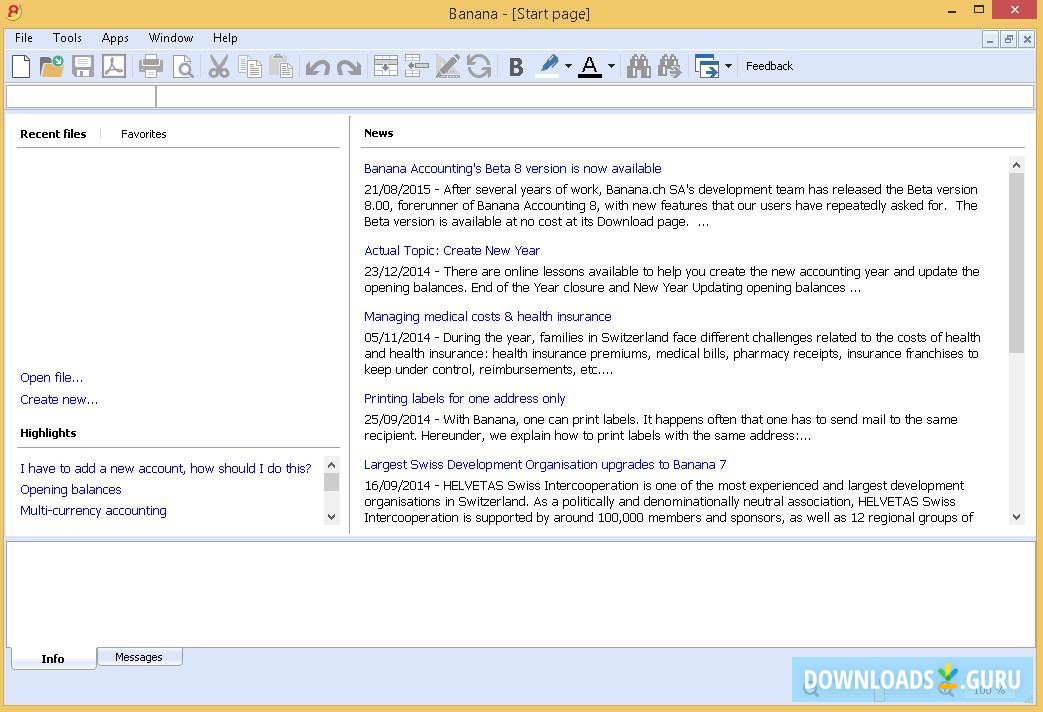

Mar 19, 2021 Banana Accounting is a professional accounting tool for small companies, studios, private users, non-profit organizations, home owners associations, churches and many others. Your accounts are perfectly in order thanks to the possibility to edit the transactions. Banana Accounting is available for Windows, Mac, Linux, Android and IOS. Save your files on local disks, cloud, or email them. Full and contextual documentation is accessible with one click. Spreadsheet inspired professional accounting software. If you are familiar with Excel, Banana Accounting will be a piece of cake. It takes a few seconds to be up and running.

Banana Accounting - Double-entry Accounting | Banana Accounting

Go to the templateMulti currency accounting template

for real estate with VAT

Double entry accounting for keeping track of the VAT transactions and printing a VAT Report for UAE.

Ready to use template for real estate company's accounts, expenses, and can be managed by department.

Banana Accounting Review

Go to the templateUAE VAT Reporting

Automatically calculate and register VAT. VAT code and VAT reporting ready to use for UAE.

The VAT Report Extension prepares a report that is similar to the UAE online VAT return , practical and easy to use.

Multi-Currency

Professional, easy to use, multi-currency double entry accounting, let you manage any type of business. Easily add accounts and currencies.

Learn more about Multy-currencyBalance Sheet

Professional looking Balance Sheet for full control over your Assets, Liabilities and Equity.

Learn more abount Accounting ReportsProfit & Loss Statement

Get full control over revenues, costs and profit. See how the situation is evolving and get detailed information.

Learn more about Accounting ReportsReliable Forecasting

Double entry based forecasting method will let you know how cash, balance sheet, and profit & loss evolved.

Learn more about Forecasting

Learn more about ForecastingBanana Accounting Tutorial

How to do your accounting in 3 simple steps

1. Create your accounting file

File->New, and choose a template that is right for you.

Enter '+emirates' in the search box for a specific UAE template.

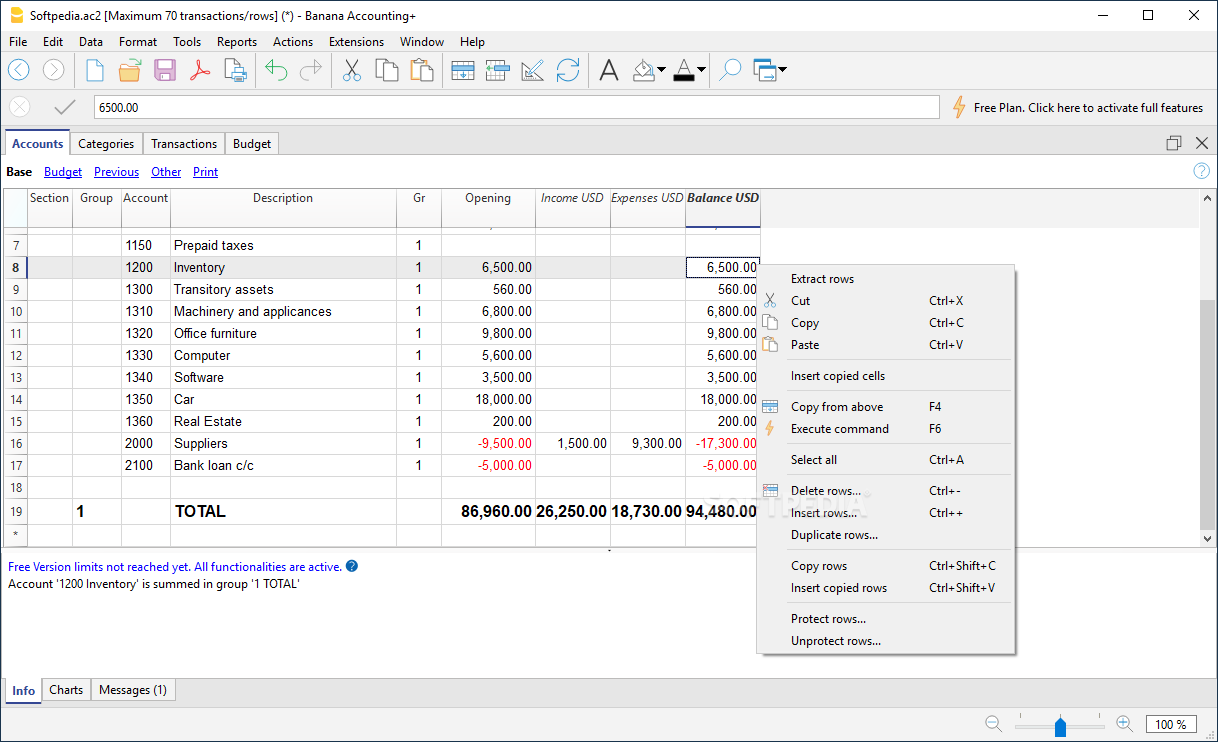

2. Customize the charts of accounts

You can modify accounts descriptions, add or remove accounts and groups at any time.

3. Enter transactions

Quickly enter and modify transactions. Use the predefined VAT Code for automatic VAT calculation.

... and your accounting is done!

You can view and print your financial situation or the VAT report.

I can manage my accounting in Chinese, and easily switch between multi languages based on my current country. The price is so low and there are so many excellent and professional templates for free! If you already know how to use Excel, then you surely know how to start using Banana without extra study time.

Feng Yong, a senior accountant in Dubai

From Goodfirms.com: 'I can proudly say it is fast, cost effective, efficient, secure and efficient at all levels of businesses.'

Senior Accounts manager at Mombasa Oil refinery company

From Capterra.com:

'Just love how flexible it is.'

Business Owner from Cyprus